Bookkeeping and accounting - do the two terms sound synonymous to you? Do you often use the two of them interchangeably? Sometimes understanding the difference between the two can be tricky.

When it comes to managing the finances of your business, making the right decision between hiring a bookkeeper or an accountant can significantly impact your company’s success. Both roles play crucial parts in maintaining financial health, but understanding their differences and knowing when to utilize each can streamline your operations and optimize your financial strategy.

Understanding The Difference Between Bookkeepers and Accountants

Bookkeeping and accounting are often lumped together by accountancy firms in the services that they offer, and we often find small business owners aren’t clear on the differences between these two distinct arms of accountancy, or even if there’s a difference at all. Yet within the industry, becoming a bookkeeper or an accountant has its own educational and skillset requirements, as well as its own paths when it comes to career progression. Most people who are training and practicing in the general industry of accounting will at some point choose whether to become a bookkeeper or an accountant. Sometimes a business will need a bookkeeper and not an accountant, sometimes it will be vice versa.

Bookkeepers and accountants will work in harmony to deliver an overall accountancy service for a business, and there is usually some overlap in their positions.

Job Roles of Bookkeepers and Accountants

Bookkeeping and accounting - They are often each other’s impersonators. Both bookkeepers and accountants work with your books of accounts. Still, there are some differences that every business owner needs to be aware of before deciding which one to hire.

What Does a Bookkeeper Do?

A bookkeeper is the more operationally involved of the two. A bookkeeper’s job will typically revolve around the usual daily tasks like ensuring the invoices are sent out on time, that any payments due are paid, that all expenses are tracked, and the like. When talking about beginner bookkeepers, usually start off doing simple data entry until they have accumulated enough experience to deal with the financial side of things. At that point, they can then train to become an accountant, studying to earn the professional Chartered Accountancy qualification. A few of the jobs a bookkeeper will commonly handle include:

- Preparing initial financial statements and tax returns based on records

- Keeping your business's financial health in check by dealing with invoices, income, outgoings, and receipts

- Integrating and managing a payroll system for businesses with multiple employees

- Overseeing accounts receivable (money owed by debtors) and accounts payable (money owed to creditors)

- Preparing your GST/HST return

- Summarising financial reports provided by digital accounting software

- Providing information for year-end reports and tax returns (typically to your accountant)

- General upkeep and reviews of financial systems put in place to improve them

To summarise, a bookkeeper is an expert in building systems that capture and provide important financial data. There may be additional responsibilities based on the unique needs of your business. When comparing these tasks and talents to those of an accountant, the differences between bookkeeping and accounting become more apparent.

What Does An Accountant Do?

In contrast to a bookkeeper, an accountant, takes a broader view of a company’s finances. They analyze financial data prepared by bookkeepers to provide insights into the company’s financial health and performance. An accountant may have to crunch the numbers given by the bookkeeper, but these are only a part of their skill set. It is vital to possess sharp logic skills and big-picture problem-solving abilities. In addition, accountants must use the small pieces of information put in place by the bookkeeper to draw much more significant and broader conclusions. Here are the most common responsibilities of an accountant:

- Preparing Income tax returns

- Conducting reviews of various company financial statements

- Performing accounts analysis

- Conducting routine audits to ensure that the company's financial statements follow ethical standards.

- Preparing forecasts and what-if analysis

- Monitoring indirect taxation and preparation of returns

- Financial risk assessment associated with contracts

- Helping make business structure decisions like carving out provisions and reserves.

Who is The Right Fit for Your Business: Bookkeeper or Accountant in Toronto?

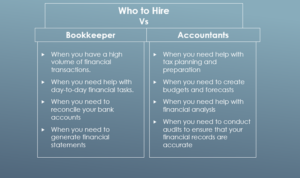

Now that we are clear on bookkeeping vs accounting, Let’s dive into the bookkeeper vs accountant riddle! Who to Hire?

Consider hiring a bookkeeper or an accountant based on your financial knowledge and skills and the complexity of your business.

Every small business is different in nature, size, and complexity. You should hire a bookkeeper or accountant in keeping with the needs and complexity of your business and your financial expertise.

Factors to Consider When Making Your Decision:

Scope of Services: Determine the range of financial services your business requires, from basic bookkeeping to strategic financial planning.

Expertise and Qualifications: Assess the qualifications and experience of potential candidates or firms to ensure they possess the necessary skills to meet your needs.

Cost and Budget: Evaluate the cost-effectiveness of hiring a bookkeeper versus an accountant, taking into account factors such as salaries, benefits, and potential savings from financial optimization.

Scalability: Consider your business’s growth trajectory and whether your chosen financial professional or firm can scale their services accordingly to accommodate future expansion.

Industry Specificity: Some industries have unique regulatory requirements or financial complexities that may necessitate specialized expertise. Ensure that your chosen financial professional has experience working within your industry.

When to Hire a Bookkeeper and Accountant in Toronto

Signs You Need a Professional Bookkeeper or Accountant

Here are six signs that you may need to hire a professional bookkeeper or accountant:

- You are spending too much time on bookkeeping tasks.

- You are not sure how to accurately track your income and expenses.

- You are struggling to prepare financial statements.

- You are having trouble complying with tax laws.

- You are making careless mistakes in your financial records.

- You need help making informed business decisions.

It will be a good idea to hire a skilled bookkeeping or accounting service or professional if you are experiencing any of these issues. They can help you to get your finances on track and save you time and money in the long run.

Hybrid Approach – Aligning the Two Roles for Small Business Success

The roles of bookkeepers and accountants are complementary, serving as the yin and yang of financial management. For small businesses, the decision to hire a bookkeeper or accountant often hinges on the size and complexity of the business.

For those with straightforward financial operations, simple bookkeeping may be feasible.

However, as your small business enters a growth phase or you have complex financial tasks, you might need to hire both a bookkeeper and an accountant or someone who can fulfill both roles. Moreover, aligning both roles also becomes increasingly valuable.

Significance of Bookkeepers and Accountants in Small Business in Toronto

The bookkeeping process is the elementary step of accounting. Both bookkeepers and accountants play a collaborative role in the success of small businesses. They together help track, record, analyze, and report financial data to enable business owners and management to:

- Monitor the business’s financial health.

- Level up cash flow management.

- Make data-driven business decisions.

- Minimize the risk of errors and fraud.

- Improve regulatory and tax compliance.

- Save money, labor, and time.

Make the smart choice for your business!

In conclusion, whether to hire a bookkeeper or an accountant depends on your business’s specific needs, financial goals, and budgetary considerations. While both roles are integral to maintaining financial stability and compliance, understanding the distinctions between them can help you make an informed decision that aligns with your business objectives. By carefully evaluating your requirements and selecting the right financial professional or firm, you can position your business for long-term success and prosperity.

If you are in Toronto searching for professional bookkeeping and accounting services that will be adapted to your particular requirements, do not hesitate to reach us. Our team of professionals can provide you with the necessary financial expertise and support to triumph over the financial aspect of your business. Feel free to reach out to Filing Taxes at 416-479-8532. Schedule an NTR engagement appointment with us and take the first step toward proper management of your finances and ensure you comply with CRA reporting and payroll deductions.

Disclaimer: The information provided on this page is intended to provide general information. The information does not consider your personal situation and is not intended to be used without consultation from accounting and financial professionals. Salman Rundhawa and Filing Taxes will not be held liable for any problems that arise from the usage of the information provided on this page.