U.S. tax filing in Canada comes with its own set of complications. Filing two sets of taxes can feel a little overwhelming. Knowing which tax rules affect you and understanding your tax filing options is a lot to stay on top of.

American citizens living in Canada will likely face tax pressure from both the U.S.-based Internal Revenue Service (IRS) and its counterpart in Canada, the Canada Revenue Agency (CRA).

The U.S. is famous for its complex tax laws and the significant penalties for failing to follow them. Working with a tax accountant in Canada to file a US tax return is the best way to ensure full accuracy and compliance. At Filing Taxes, our experienced accountants in Toronto can assist you with the full process, including preparation and filing.

They will help you understand your obligations and their impact on your international tax and wealth planning. With our expertise, you can be confident that you have the best tax plan in place.

Frequent changes to the tax system in the US complicate tax planning. It is imperative to strategically and proactively manage both corporate and personal taxation requirements to prevent outsized tax liabilities or double taxation and avoid costly penalty fees. In this complex universe, Filing Taxes helps you find your way around and advises you on the best avenues.

We provide tax services that integrate both your personal and corporate interests, providing you with a strategic plan that cuts through the ‘red tape’ and allows you to enjoy an international lifestyle, operate, and live across borders with ease and efficiency.

Our expert accountants in Toronto help navigate the complicated world of taxes and advise you on the best course of action to file US tax returns. Filing Taxes provides proactive advice and support so that high-net-worth individuals, business owners, and their businesses can effectively manage their tax obligations. Planning ahead helps you minimize tax and ensures all compliance requirements are met on a timely basis.

Filing Taxes is a cross-border accounting firm in Toronto that specializes in Canada-US tax planning and preparation. Whether you want to visit an office or file online, our expert cross-border tax accountants in Toronto will take care of it for you.

Whether you are moving to or from the US, planning a US business venture, or considering investing at home or abroad, we offer comprehensive services. There is much to consider for you and your family, so let our team of accountants in Toronto get you started on the right foot with a comprehensive plan that will give you one less thing to worry about.

If thinking about Filing U.S. Tax Returns in Canada makes your head spin, you can rest easy—Filing Taxes is here to help.

Our CPAs (Chartered Professional Accountants in Toronto) regularly assist clients with filing US tax returns if they are required to file. We provide personal US tax return filing as well as business tax filing depending on our clients’ needs. Our services include but are not limited to:

To use the IRS expat tax amnesty program, you need to certify that your past failure to file was non-wilful. You can do that by

If the IRS agrees that you are eligible for the program, then there will be no penalties imposed. Filing Taxes Savvy tax accountants in Toronto offer a range of options for those who wish to file for previous years. We seek to not only simplify the process, but to fulfil all US tax filing requirements, maintain tax compliance, and reduce double taxation wherever possible.

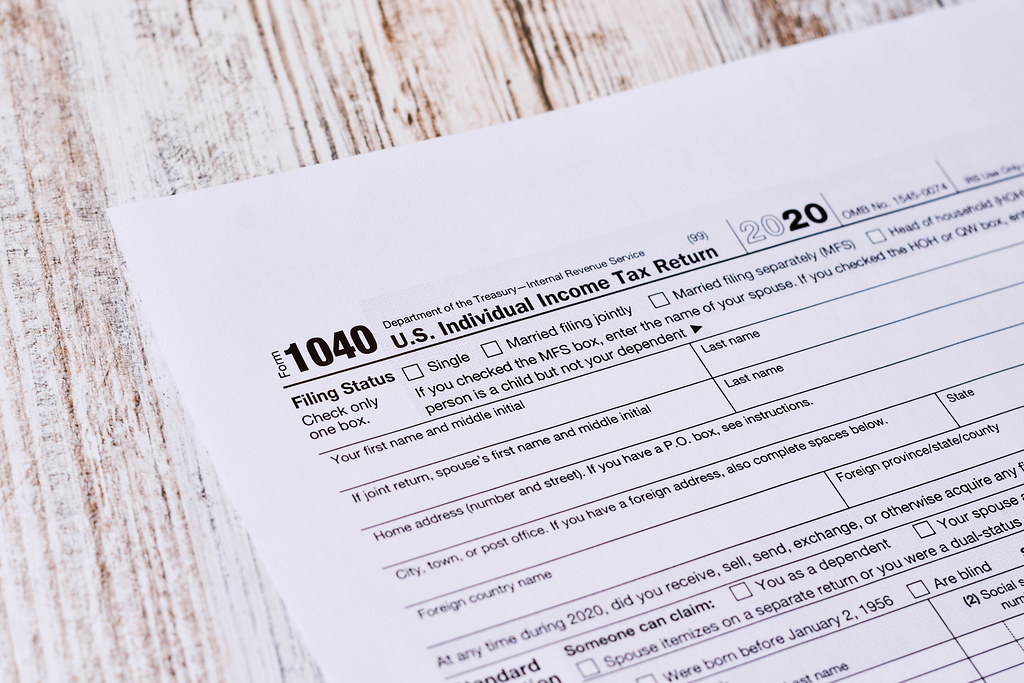

To file a US tax return you will need an Individual Taxpayer Identification Number (ITIN) or Social Security Number (SSN) issued by the United States government. If you do not have either of these, you will need to apply for an ITIN to file.

You also must obtain the relevant US tax return forms. This can either be done by mail, through an accountant or bank, or US tax accounting software.

Finally, you must submit your US tax return by mail to the IRS in the United States in the indicated time frame to avoid penalties.

There are multiple US tax return forms that you may need to file. Our tax accountant in Toronto can verify which forms are required for you.

This is the standard federal income tax form used to report an individual’s gross income. It allows taxpayers to claim expenses and tax credits, itemize deductions, and adjust income. It is filed by US persons including US citizens, green card holders, or residents for US federal income tax purposes (including those who pass the substantial presence test).

This form is for non-residents who are not US citizens, have not passed the green card test, and have not passed the substantial presence test. If you made above the personal threshold income of US $3000 or do not fall into the provisions of the Canada-US income tax treaty, you will need to fill out this form.

If you are relying on the Canada-US tax treaty provisions to be exempt from US tax or to reduce applicable US tax withholding, you need to submit this form. Late filing of this form can lead to additional penalties from the IRS. This form will be filled alongside Form 1040.

This form is for foreign corporations (not individuals) that have earnings effectively connected with trade in the United States. This is a treaty-based return that relies on the Canada-US income tax treaty as well.

In addition to corporate and individual US tax services, Filing Taxes also provides clients with non-resident tax filing services. A non-resident has not passed the green card test or the substantial presence test.

You must file a return if you are a non-resident engaged or considered to be engaged in a trade or business in the United States during the year. Form 1120-F - US Income Tax Return of a Foreign Corporation

Even if you are not engaged in a trade or business in the United States, you must file a return if you have U.S. income on which the tax liability was not satisfied by the withholding of tax at the source.

You also must file an income tax return if you want to claim a refund of excess withholding or claim the benefit of any deductions or credits (for example, if you have income from rental property that you choose to treat as income connected to a trade or business).

As a non-resident, a Canadian is generally exempt from US tax filing. However, there are certain situations and thresholds set by the United States to determine if you need to file a US tax return.

Filing Taxes expert accountants in Toronto can help you navigate the whole criteria to determine your US tax filing status and file your US tax return with accuracy to minimize tax liability.

In addition to corporate and individual US tax services, Filing Taxes also provides clients with non-resident tax filing services. A non-resident has not passed the green card test or the substantial presence test.

You must file a return if you are a non-resident engaged or considered to be engaged in a trade or business in the United States during the year. Form 1120-F - US Income Tax Return of a Foreign Corporation

Even if you are not engaged in a trade or business in the United States, you must file a return if you have U.S. income on which the tax liability was not satisfied by the withholding of tax at the source.

You also must file an income tax return if you want to claim a refund of excess withholding or claim the benefit of any deductions or credits (for example, if you have income from rental property that you choose to treat as income connected to a trade or business).

As a non-resident, a Canadian is generally exempt from US tax filing. However, there are certain situations and thresholds set by the United States to determine if you need to file a US tax return.

Filing Taxes expert accountants in Toronto can help you navigate the whole criteria to determine your US tax filing status and file your US tax return with accuracy to minimize tax liability.

This will close in 0 seconds