My Account with Canada Revenue Agency (CRA) is the best way to make sure you are taking advantage of all the government benefits available to you and your family.

What is the CRA My Account?

The Canada Revenue Agency (CRA)’s My Account is a secure portal that lets you view and manage your tax-related and benefits information online. This is the best way to keep up to date and manage all your affairs with CRA. Most of the service providers are moving online and reducing physical mail. Well, the CRA is no exception.

My Account is your one-stop online Canada Revenue Agency service channel.

Why Should I Register My Account with CRA

My Account is:

- Convenient – It is available 21 hours a day, 7 days a week (see Hours of service).

- Easy to use – After registering, simply log in with your CRA user ID and password.

- Fast – Information is up-to-the-minute, and transactions are processed immediately.

- Secure – The CRA user ID and password are just part of the security.

Services You Can Avail through My Account

My Account is your one-stop online Canada Revenue Agency service channel. With the My Account, you’ll have access to the following services:

- View a detailed status of your tax return

- View your notice of assessment (NOA) or reassessment (NOR)

- View and download your information slips

- Request an Express NOA

- Use Autofill my Return (AFR) service to automatically complete parts of your tax return with information the CRA has on file for you

- View your unused or carryforward amounts (such as unused tuition amounts, RRSP contributions, etc.) from previous years

- View your Home Buyers’ Plan (HBP) and Lifelong Learning Plan (LLP) details

- Start and/or manage your direct deposit details

- View your benefits’ status and payments

- Change your personal information

- Receive online mail

Note: This is not a complete list. Refer to the CRA website for a full list of services you can access with the My Account.

Registration to Process

Setting up My Account on the CRA website is simple and straightforward. To register go to canada.ca/my-cra-account.

STEP 1- Before you start, make sure you have the following personal information handy:

- Social Insurance Number

- Date of birth

- Current address

- Copy of your most recent tax return

- Current postal code or zip code

Important: To register for My Account, you must have filed a tax return for the current or a previous year.

STEP 2- Choose 1 of 2 ways to register for My Account:

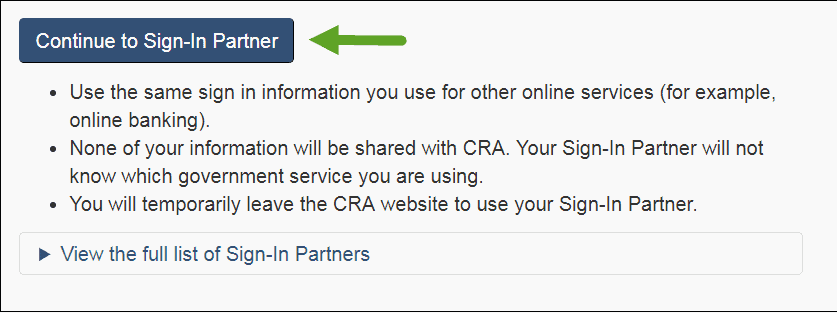

• using Sign-in Partner (such as your bank)

- On the CRA’s My Account for Individuals page, click the Continue to Sign-in Partner button.

2. Select your Sign-In Partner (such as the financial institution you bank with).

3. You’ll be taken to your Sign-in Partner’s website. Log in with the username and password that you normally use for this website.

4. Enter the requested information (such as your social insurance number, date of birth, current postal code, and an amount from your current or previous tax return).

5. Once you complete the registration process, you’ll have instant access to some of your tax information.

Within 10 business days, you’ll receive a letter from the CRA with your CRA security code. Log in to your My Account using your Sign-in Partner. When prompted, enter the CRA security code you received. Keep in mind, your CRA security code has an expiry date – be sure to follow instructions in the CRA letter before the code expires.

Once you enter the CRA security code, you’ll be able to access all of the services offered by My Account.

• creating a CRA user ID & password

- On the CRA’s My Account for Individuals page, click the CRA register button.

- Enter your Social insurance number and click Next.

- Enter the requested information (such as your date of birth, current postal code, and an amount from your current or previous tax return).

- Create a CRA user ID and password.

- Create your security questions and answers.

- Once you complete the registration process, you’ll have instant access to some of your tax information.

Within 10 business days, you’ll receive a letter from the CRA with your CRA security code. Log in to your My Account using your CRA user ID and password. When prompted, enter the CRA security code you received. Keep in mind, your CRA security code has an expiry date – be sure to follow instructions in the CRA letter before the code expires.

Once you enter the CRA security code, you’ll be able to access all of the services offered by My Account.

STEP 3- Enter your CRA security code:

Once you receive your CRA security code, return to My Account, log in and enter your security code when prompted.

You now have full access to all the My Account features!

When should I register for My Account with CRA?

Want to make your life easier with hassle-free access to your tax and benefits information? Consider registering for a CRA My Account today.

Tax time can be a headache! Take control of your accounts and finances by opening a CRA online account. If you need any further help to start the registration process, For advice and assistance with tax planning, a CRA tax dispute, or other tax issues, get in touch with Filing Taxes today to see how we can help. Experts at Filing Taxes will be happy to assist business owners in this pursuit. To speak with an experienced accountant, contact Filing Taxes either at 416-479-8532 or [email protected]. Schedule an NTR engagement appointment with us and take the first step towards proper management of your finances.

Disclaimer: The information provided on this page is intended to provide general information. The information does not consider your personal situation and is not intended to be used without consultation from accounting and financial professionals. Salman Rundhawa and Filing Taxes will not be held liable for any problems that arise from the usage of the information provided on this page.