Many self-employed people and regular workers utilize a corporate automobile for these purposes, whether it be a client appointment in another city, a financial conversation at the bank, or a journey to the airport before a business trip.

You might be able to claim a car expenditure deduction on your subsequent Canada Revenue Agency (CRA) tax return if you travel for work. However, it is typically utilized for both personal and professional travel.

According to the law, taxes must be paid on this benefit just like they would on a monetary income. The self-employed, business owners, and workers who have access to corporate vehicles are all included in this. You must be sure to keep an exact mileage log of all work travel in order to support your claims if you choose to do this.

In this blog, you will learn all the important details that you might need for the mileage logbook.

What is a mileage logbook?

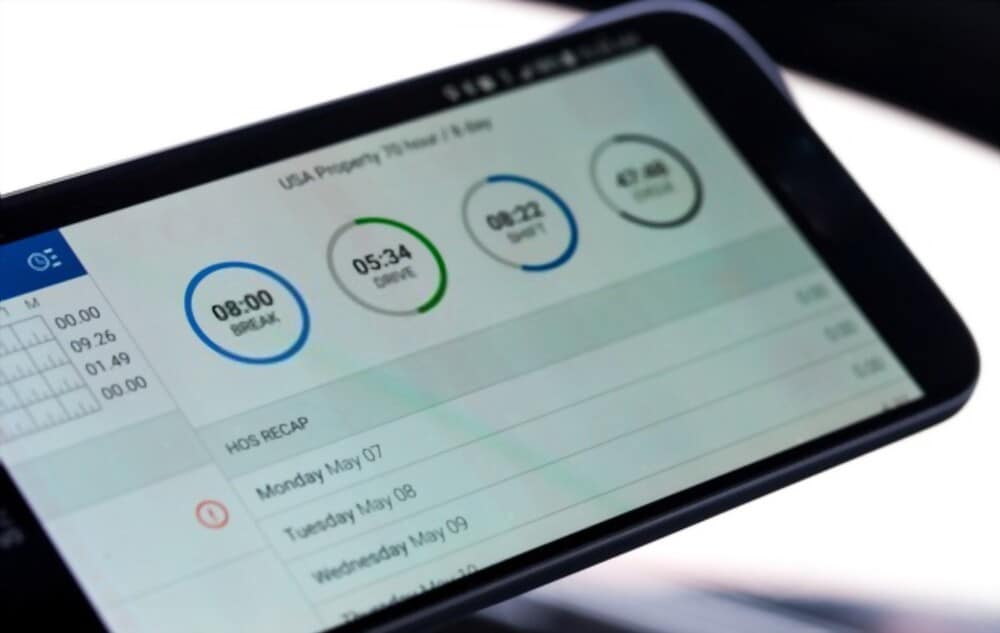

A mileage log, sometimes known as a logbook, serves as a record of the journeys you make in your car. Your log must include a record of both if you use the same vehicle for work and personal use. You must be able to show that you travelled the distance you claim only for business purposes, which is why you must document both.

Every entry in your logbook has to contain the date, the reason for the journey, the location, and the distance covered. The readings on your odometer at the beginning and end of the year should also be recorded. You could keep a logbook differently depending on your circumstances.

The Canada Revenue Agency (CRA) logbook requirements

The logbook method

To support your claims for reimbursement while utilizing the logbook technique, you are required to keep a record of all your driving in a mileage log.

If you want to utilize the complete logbook technique, you must record both your personal and any business-related driving distance. This calls for keeping a note of every mile you travel and classifying it as either a personal or work journey.

The CRA states that you can only write off costs if they are reasonable and are accompanied by receipts. The following details should be recorded in your logbook any time the vehicle is used for business purposes:

- Date

- Destination

- The business purpose of your trip

- Vehicle starting mileage

- Vehicle ending mileage

- Total miles driven

- Vehicle expenses, type (gas, oil, tolls, etc), and amount

How long do you need to keep your logbook?

Maintaining records and ancillary materials like receipts for a minimum of six years is a good idea. If you ever face an audit, you will be able to support your claims with this. Keep a copy of your whole logbook for six years after you stop using it, as well as for the duration that you are still using it. In other words, if your entire logbook was established in 2009 and you used it to calculate your yearly driving percentage up until 2015, you must maintain a copy of it until recent years. For instance, you can deduct 80% of your overall vehicle expenses from your taxes if you use your car for work 80% of the time. Keep a unique logbook for each car you use for business purposes if you have more than one. You must compute each car separately when claiming a vehicle expenditure deduction for numerous vehicles.

Conclusion

In conclusion, we have learned about how a logbook serves as a record of journeys you make in your car. Your log must include both if you use the same vehicle for work and personal use. You must be able to show that you travelled the distance you claim only for business purposes.

You can deduct 80% of your overall vehicle expenses from your taxes if you use your car for work 80% or more of the time. To support your claims for reimbursement, you are required to keep a record of all your driving in a mileage log. The Canadian Revenue Agency (CRA) states that you can only write off costs if they are reasonable and are accompanied by receipts.