The Canada Revenue Agency (“CRA”) conducts a broad range of activities to ensure taxpayers are compliant with tax laws and to maintain the integrity of Canada’s self-assessment system.

The idea of getting audited by the Canada Revenue Agency is risky, stressful, time-consuming, and can create unnecessary hardships.

CRA pursues the categories of taxpayers it finds to be at a higher risk of tax negligence. People at an increased audit risk involve individuals who work in the construction or restaurant industry, are self-employed, or have repeated losses from their business.

Being audited by CRA can be an intimidating experience. If not handled properly, a CRA audit can eat a massive chunk of your income. It may result in penalties and interest that can be devastating to your financial situation. For this reason, you should contact a professional for CRA audit assistance as soon as you receive the audit letter from CRA.

Many Canadians make the costly mistake of representing themselves and end up volunteering too much information to make things more complicated. Individuals tend to accept rulings without fully understanding the auditor’s judgment. CRA auditors often make taxpayers feel defensive and vulnerable. Having someone with professional knowledge about the process and knowing your rights throughout that process can be empowering.

What is the CRA Audit Process?

The audit usually starts when you receive a letter from CRA where they tell you about their intention to audit. This letter will put you on notice and outline the information it wants from you, like specific documents and details. After receiving this letter, you must make submissions that the auditor will review.

After reviewing the documents, the auditor may give you a green signal or determine that there is some problem. If there’s a problem, you’ll receive a letter that sets out the proposed reevaluation and the reason for it. This gives you another chance to submit the documents and dissuade the auditor.

Auditors don’t always respond or listen to your reasoning, which can be trouble for you. That’s why working with a professional tax accountant from the beginning is always recommended. This will help you stand empowered during the audit process.

CRA Audits may entail:

Why Should I Hire a Professional to Deal with the CRA

An expert, typically an accountant, can organize the information in such a way that the auditor can understand what has been done and why. Getting familiar with regulations about your case can help ensure you are treated fairly and efficiently.

Proper documentation and strong evidence are the keys to putting across your points to the CRA. An accounting firm doing a tax audit can help in sailing through this challenge. However, if you come across the fact that any tax errors have been made that need to be resolved, a professional accountant provides the support to correct them. An expert accountant ensures accuracy and proper source documentation papers with your records to satisfy the CRA Audit.

A professional accountant can help you with the below tax audit support:

Advantages of Hiring a Professional Tax Accountant For CRA Audit

Professional tax accountants can give a definite strategy to free taxpayers from the complicated process of dealing with the CRA

1. A professional tax accountant will protect your rights as a taxpayer

One of the rights of a taxpayer is the prerogative to choose a tax professional who can represent him/her before the CRA. This right to tax professional representation is enshrined in the Taxpayer Bill of Rights of Canada.

The mindset of most people is that getting the services of a tax professional is a show of guilt. But, no, it’s not. We have to change this negative thinking because picking a representative who knows about tax law can give you peace of mind when it comes to your tax issues.

A tax accountant has considerable knowledge about tax litigation and knows how to deal with the CRA to defend your rights as a taxpayer and protect your assets.

2. You won’t deal with the CRA directly

Working with a tax accountant gives you the benefit of not having to deal with the CRA directly. All you have to do is talk with your representative, and the latter will speak and negotiate with the tax agency on your behalf.

3. A tax accountant is competent to handle matters, such as:

It’s not easy to handle your tax problems on your own. Just imagine the work you have to put in throughout a complex tax audit or proceedings. You need to have an effective tax professional to ensure that you’ll overcome your tax issues. It will also save you time and effort.

4. You can settle your tax debt for less – save yourself from hefty penalties

There’s also the possibility of settling your exorbitant taxes in the lowest possible settlement if you hire a professional tax accountant. Tax accountants are well-versed in the Canadian tax code and know what are the existing loopholes so that they can reduce their clients’ tax debt or get you tax debt relief.

If your tax debt already amounts to thousands of dollars, of course, you want to minimize it as much as possible. Hiring a tax professional is the key for you to save money on your tax obligations. Your tax specialist can settle your tax debt with the CRA for less or make an Offer in Compromise to lessen what you owe to the tax bureau.

A tax accountant can also eliminate the accumulated penalties and interest to make your tax debt affordable to pay. There are cases when taxpayers only have to pay the principal amount of what they owe after a successful negotiation with the CRA through the help of tax attorneys.

Tips When Hiring An Accountant for Tax Resolution with the CRA

You need to make sure that you hire a licensed specialist tax accountant to help you with your tax problems. Here are some tips you have to keep in mind when hiring a tax accountant:

CRA audit is a detailed, comprehensive process – Get an expert involved

We understand the details and complexities involved in the Canadian tax system and can help individuals and businesses dispute their tax assessments and achieve their desired resolution. Using a combination of in-house experts and strategic partners, we offer a selection of premium accounting services to help you financially succeed. If you have any questions about your taxes or need assistance with filing, consider reaching out to Filing Taxes tax professional for guidance at 416-479-8532. Schedule an NTR engagement appointment with us and take the first step toward proper management of your finances.

Disclaimer: The information provided on this page is intended to provide general information. The information does not consider your personal situation and is not intended to be used without consultation from accounting and financial professionals. Salman Rundhawa and Filing Taxes will not be held liable for any problems that arise from the usage of the information provided on this page.

It seems we hear about victims of fake Canada Revenue Agency (CRA) scams daily. Unfortunately, some scammers take advantage of stressed-out people (especially at tax time) who may not immediately recognize that they’re being scammed.

With new and sophisticated tactics appearing every day, it’s not that uncommon for people to be duped by a tax scam and it can happen to the best of us. You need to be cautious when dealing with so-called emails, texts, or phone calls coming from the CRA.

Be vigilant in protecting your personal information if someone initiates contact with you and then asks you to verify your identity by providing them with your social insurance number, bank account information, credit card numbers, or even passport numbers. These are all scams designed to steal your money and identity.

Is it real or fake? How to spot a CRA scam

To protect yourself, it’s important to be able to distinguish communication from the CRA and a tax or phishing scam. Legitimate CRA employees will identify themselves when they contact you. The employee will give you their name and phone number. Make sure the caller is a CRA employee before you give any information over the phone. This will protect you from giving money or personal information to a scammer.

By telephone

You may receive a call from the CRA for questions about your taxes, offer support to your small business through the Liaison Officer Service, or even begin an audit.

They may ask you to verify you're identity, asking for your full name, date of birth, address, or social insurance number.

The CRA will not employ high-pressure tactics to get you to provide your passport number, health card, or driver’s license.

The CRA will not demand immediate payment in the form of bitcoin, prepaid credit cards, e-transfer, or gift cards from retailers like Amazon or iTunes.

On top of that, the CRA will not leave hostile voicemails or use intimidating language, and threaten to send the police over to your residence and take you to jail.

If you are uncertain about the legitimacy of a call from the CRA ask the caller for a callback number to verify the call. Hang up then call the CRA. Explain the situation. If it is a real inquiry from the CRA they will be able to verify it.

By text message or instant messenger

The only time you will receive a text message from the CRA is to verify your identity through their new multi-factor authentication process. If you have opted to verify your identity through text, you will receive a one-time passcode to access your online accounts.

This is a text message that is always initiated when you are logging into any of your online accounts. If you receive a text message at any other time, you should delete it. If it seems legitimate and you have NOT tried logging into your account, contact the CRA.

The CRA will not contact you through an instant messaging app such as WhatsApp or Facebook and they do not use these methods to communicate with Canadian taxpayers.

If you receive a text or instant message claiming it is from the CRA, delete it. It’s likely a phishing attempt to obtain access to your bank account or other personal information.

By email

Suppose you have registered for email correspondence and provided an email address in your CRA account. In that case, the CRA may send you an email alerting you when a new document or notice of assessment or reassessment is ready. To access these documents you will need to sign in to your CRA account.

The CRA could also send you an email with a link to a form or publication on the CRA website. But, they will only do this if you ask for it during a phone conversation with the CRA. This is the only time the CRA will ever send an email with a link.

The CRA will not ask you to click on an unsolicited link or ask you to fill out an online form looking for personal or financial details and you will never receive an email with a link for you to click to get your refund.

And, like the telephone, they will never email you looking for immediate payment by e-transfer, bitcoin, or prepaid credit cards.

The sender may use an email address that appears to be from the CRA, Interac, or a financial institution. Unfortunately, it is not uncommon to forge an email address and this is known as email spoofing.

By mail

You could receive mail from the CRA asking you for information, such as the name of your bank. They could also send a notice of assessment or reassessment and ask you to make a payment through approved channels.

The CRA could even use the mail to initiate legal action to recover any money if you refuse to pay your taxes. Moreover, the CRA uses the mail to tell you it’s starting an audit process.

The CRA will not send you something in the mail asking you to meet up with them in person to take payment, demand immediate payment, or threaten to take you to jail.

When to be suspicious?

Red flags that suggest a caller is a scammer include (but are not limited to):

How to protect yourself?

There are several ways you can protect yourself from fake CRA scams.

What to do if you believe you’ve been scammed

The first thing you should do is contact your local police. Provide them with as much information as possible, including copies of correspondence sent and received.

If your Social Insurance Number has been stolen, contact Service Canada. For more information on protecting your Social Insurance Number, go to the Service Canada website.

If you believe your login information with the CRA has been compromised, contact the CRA. If you have support in place through a professional tax consultant have them call on your behalf. Once the CRA has been notified, they will confirm if your account has been compromised and they will take action to prevent the fraudulent use of your personal information.

The government also recommends reporting the scam or scam attempt (whether or not you are a victim) to the Canadian Anti-Fraud Centre. Connect with them online or by phone.

Want to report a potential scam?

You should report a scam if you suspect either of the following:

To report a scam, visit antifraudcentre.ca, or call. If you think you may be the victim of fraud or you unknowingly provided personal or financial information, contact all of the following:

You should contact the CRA if you:

About Filing Taxes

We have worked with tens of thousands of farm and small business owners across Canada. We optimize their tax returns, maximize their tax savings, support their financial and estate planning needs, and give them the back office help they need with bookkeeping and payroll. Our corporate services include minute book filing and annual returns.

Filing Taxes with its highly trained professional accountants provides you with quality services that give you the true value of investing your time and money. Feel free to reach out to Filing Taxes at 416-479-8532. Schedule an NTR engagement appointment with us and take the first step toward properly managing your finances.

Disclaimer: The information provided on this page is intended to provide general information. The information does not consider your personal situation and is not intended to be used without consultation from accounting and financial professionals. Salman Rundhawa and Filing Taxes will not be held liable for any problems that arise from the usage of the information provided on this page.

The Old Age Security (OAS) pension is one of three main retirement income sources for seniors in Canada. It is designed to help seniors meet their income needs in retirement.

OAS is a monthly benefit available to anyone age 65 or older.

If you happen to be a senior whose income is below a certain amount, the OAS will also include the Guaranteed Income Supplement (GIS).

As part of your retirement income with the Canada Pension Plan (CPP), it’s important to understand how much OAS you’ll receive so you can be confident you’ll have enough retirement income.

Like the Canada Pension Plan (CPP), OAS is paid out to eligible recipients once every month, with direct deposits hitting your bank account on specific dates.

Unlike the CPP, you don’t need to make any contributions during your working years to qualify for the OAS pension.

To qualify for the OAS, you must be at least 65 years of age and resident in Canada at the time when your application is approved. You must also have lived in Canada for at least 10 years.

OAS recipients who currently live abroad may qualify if they meet the age requirement and were citizens or legal residents before leaving Canada.

They must also have lived in Canada for at least 20 years since the age of 18.

If you don’t meet these requirements, you may still qualify for OAS if you lived in a country that has a social security agreement with Canada and made contributions to that country’s social security system.

You receive the full OAS pension amount if you have lived in Canada for at least 40 years since turning 18.

If you have lived in Canada for less than 40 years as an adult, you get a partial benefit based on how long you have resided in Canada.

For example, if you lived in Canada for 30 years after age 18, you get 30/40th of the maximum benefit which is equivalent to $481.87 (i.e. $642.25 x 75%).

You can increase the OAS pension amount you qualify for by delaying your first payment past age 65.

OAS pension can be deferred for up to 5 years until age 70. For every month you delay, your pension payment increases by 0.60% for a maximum increase of 36% by age 70.

The maximum monthly OAS payment in 2024 is $778.45.

This amount is revised every quarter in January, April, July, and October to account for increases in the cost of living.

For example, the OAS amount increased in the January to March 2024 quarter to reflect an increase in the Consumer Price Index (CPI).

Your OAS pension benefit is paid into your bank account on these dates in 2024:

If you haven’t yet set up a direct deposit and currently get your benefits by cheque, it may arrive on or after these dates.

Note that the Federal government is switching from cheques to direct deposit for all payments and benefits.

You can set up direct payments to a bank in Canada by calling 1-800-277-9914 or online through your My Service Canada Account.

For foreign banks, complete the foreign direct deposit enrolment form

Service Canada may automatically enroll you for OAS or send you a letter asking you to apply.

If you haven’t received notification that you are enrolled after turning 64, you can apply online through My Service Canada Account or complete the paper application (Form ISP-3550) and mail it to the nearest Service Canada Centre.

For questions about your OAS benefit, contact Service Canada at 1-800-277-9914 or TTY at 1-800-255-4786.

In some cases, Service Canada will be able to automatically enroll you for the OAS pension. In other cases, you will have to apply for the Old Age Security pension. Service Canada will inform you if you have been automatically enrolled.

In most cases, you do not have to apply to get this benefit.

OAS pension benefits are taxable, and you should report them on your annual income tax return.

The tax you pay depends on your income tax bracket.

You can ask the CRA to withhold taxes at the source every month or pay quarterly. You can have income tax automatically deducted from your OAS payments to help eliminate big surprises at tax time.

Lower-income seniors may also qualify for the Guaranteed Income Supplement (GIS). This tax-free monthly benefit increases their income so they can afford day-to-day living expenses.

The maximum monthly GIS amount in 2024 is $1,057.01 and GIS payments vary based on your marital status and income.

Seniors ages 60-64 years who are married (or common-law partners) to a GIS recipient may qualify for the Allowance benefit.

The maximum Allowance amount in 2024 is $1,292.61.

Lastly, if you are a low-income senior between ages 60 and 64 and your partner or spouse has died, you may qualify for the Allowance for the Survivor benefit.

The maximum Allowance for the Survivor amount in 2024 is $$1,524.70.

[sp_easyaccordion id="4988"]

Professional accountants at Filing Taxes can help you

If you have more concerns about the Old Age Security Program don’t hesitate to contact the Filing Taxes team of professional accountants today at 416-479-8532. Schedule an NTR engagement appointment with us and take the first step towards proper management of your finances.

Disclaimer: The information provided on this page is intended to provide general information. The information does not consider your personal situation and is not intended to be used without consultation from accounting and financial professionals. Salman Rundhawa and Filing Taxes will not be held liable for any problems that arise from the usage of the information provided on this page.

The Canada child benefit (CCB) is one of the key government benefit programs available for families with children in Canada.

It’s no secret that raising a family is expensive. For some parents, the costs that accompany the care and upbringing of children can strain their finances, causing hardship and emotional stress as they struggle to pay bills and purchase everyday items.

Both federal and provincial governments have implemented many kinds of programs over the years to help reduce parents’ financial burden. Some programs put money directly into parents’ bank accounts regularly, while others provide federal tax credits and GST/HST rebates.

One popular type of benefit program is the Canada Child Benefit (CCB).

The CCB is a tax-exempt benefit program available for eligible families with children under 18 years of age. The program’s goal is to help alleviate poverty by providing struggling parents with access to government-sponsored financial aid. The CCB is aimed at eradicating child poverty in Canada, and it is unique in that the benefits received are not considered taxable income.

The CCB payment you get may also include provincial and territorial program benefits such as:

To qualify for the CCB, you must be the primary caregiver for a child under 18 years of age and live with them and be a Canadian resident for tax purposes. Also, you or your spouse must be considered at least one of the following:

You can apply for the CCB right after your child is born using one of three methods:

1. Through Birth Registration

Apply for the CCB when registering the birth of your child in your province or territory. This is often completed at the hospital.

Each province has its own birth registration package you must complete. Ensure you provide your social insurance number and consent so that relevant information can be shared with the CRA.

2. Apply Online

Navigate to “Apply for child benefits” once you’re logged into your account with the CRA. Confirm all your information, provide details for your kid, and submit any documents requested.

3. Through the Mail

CCB applications can be completed by filling out Form RC66 and mailing it to the nearest tax center.

New immigrants in Canada need to complete Schedule RC66SCH and Form RC66 to apply for Canada Child Benefits.

If you have questions regarding the application process, you can contact the CRA’s Canada child benefit phone number at 1-800-959-8281

For the tax year 2021, you’ll receive payment from July 2021 to June 2022. The maximum you can receive is $6,997 annually for each child under the age of 6 and up to $5,903 for each child between the ages of 6 and 17. If you share custody of your children, you’ll get 50% of what you’d have received if you had full custody.

Maximum CCB Payments

| Per Year | Per Month | |

| Children under the age of 6 | $7,437 per child | $619.75 per child |

| Children between 6 and 17 years of age | $6,275 per year | $522.9 per child |

The government will calculate the monthly amount you qualify for based on your previous years’ tax return. You can use the Government of Canada website CCB calculator to get an idea of what monthly payment you can expect to receive.

The size of your CCB benefit is calculated using several factors, including:

Your family's net income is one of the most important things that determines how much money you can get from the CCB program. If your family's net income is less than $32,028 per year, you will receive the maximum payment. CCB benefits are clawed back based on your family's net income and the number of children you have.

For example, if you have two children under the age of 6, the maximum you can receive is $6,997 per child, that’s $13,994 per year. However, let’s say you have a family net income of $95,000. Your benefit would be reduced by $5,044 + 5.7% of your income over the threshold ($69,395). That means you’d qualify for $7,162.5. Below is an illustration of the CCB payment calculations.

CCB Payment Reductions Depending on Income Level and Number of Children

| Number of children | Family net income over $32,028 and up to $69,395 | Family net income over $69,395 |

| 1 | 7% of your income above the threshold | $2,616 + 3.2% of your income above the threshold |

| 2 | 13.5% of your income above the threshold | $5,044 + 5.7% of your income above the threshold |

| 3 | 19.0% of your income above the threshold | $7,100 + 8% of your income above the threshold |

| 4 + | 23.0% of your income above the threshold | $8,594 + 9.5% of your income above the threshold |

Extra Temporary CCB Payments

COVID-19 has impacted the lives and income of many Canadians. In fact, according to a recent RBC study, women have been particularly impacted with more than 20,000 women leaving work while more than 68,000 men joined the labor market. Of the +20,000 women, approximately two-thirds were forced out to care for their children.

As a result, the Government of Canada has responded and is now offering Canadians with children additional support. Those eligible will receive an additional $600 or $1,200 to their Canada Child Benefit. You can get the $1,200 extra CCB payment if you’re annual family income is less than $120,000. You’ll receive the payment in $300 quarterly installments. Families with an annual income of more than $120,000 will get $600 extra which will be paid in quarterly installments as well ($150/quarter).

Basically, with the extra temporary CCB payments, families can now receive a maximum of $7,965 for each child under 6 or $6,908 for each child between 6 and 17.

The CCB payment period starts in July and ends in June every year. Generally, you should receive your first payment 8 weeks after sending your online application and 11 weeks if you send it by mail. The CCB payments will be sent out to qualified applicants on the following dates:

| Canada Child Benefit (CCB) Payment Dates 2023 | Canada Child Benefit (CCB) Payment Dates 2023 |

| January 20, 2023 | January 19, 2023 |

| February 20, 2023 | February 20, 2023 |

| March 20, 2023 | March 20, 2023 |

| April 20, 2023 | April 19, 2023 |

| May 19, 2023 | May 17, 2023 |

| June 20, 2023 | June 20, 2023 |

| July 20, 2023 | July 19, 2023 |

| August 18, 2023 | August 20, 2023 |

| September 20, 2023 | September 20, 2023 |

| October 20, 2023 | October 18, 2023 |

| November 20, 2023 | November 20, 2023 |

| December 13, 2023 | December 19, 2023 |

Please note that if your total yearly CCB payment is less than $240, you will not receive monthly payments. Instead, you’ll receive it in one lump sum in July.

The Canada Child Benefit is a tax-free payment which means it is not included in your taxable income. It is also not reported on your income and benefits tax return.

While CCB payments are tax-free, you should always file your tax return every year even if you have no income to report.

The CRA automatically assesses your eligibility for CCB by looking at your tax return for the previous year.

Canada Child Benefit Young Child Supplement (CCBYCS)

The CCB young child supplement (CCBYCS) provided up to four extra payments to families with children under age 6 in 2021.

To be eligible, you must have a child under age 6 in January, April, July, or October.

You get $150 to $300 per child based on your family net income in 2019 and 2020. The January and April 2021 payments were made as follows:

The payments in July and October 2021 were made as follows:

CCB Young Child Supplement Payment Dates

CCBYCS was paid separately from CCB with the payment dates on:

There is no indication from the government that supplemental CCB payments will continue in 2022.

The Child Disability Benefit (CDB) is paid to eligible families who have a child under 18 that suffers from a severe and prolonged impairment that limits them physically or mentally.

The maximum Canada Disability Benefit for the period of July 2021 to June 2022 is $242.91 per month or $2,915 per year.

The CDB is included in CCB payments for those who qualify and payment dates occur on the same dates as the CCB as follows:

While the CCB is administered and funded by the federal government, there are also child benefit programs at the provincial and territorial levels.

Some of these programs include:

Most of these programs are administered by CRA and combined with the monthly CCB payments as a single credit to beneficiaries.

One of the few exceptions is the Alberta Child and Family Benefit (ACFB). This is paid quarterly, and the ACFB payment dates for 2023 are:

The Alberta Child and Family Benefit (ACFB) was introduced in July 2020 to replace two separate programs: Alberta Child benefit and Alberta Family Employment Tax Credit.

[sp_easyaccordion id="4687"]

The CCB is a program that you should investigate if you have children or plan to in the near future. It’s easy to apply for, and you can expect regular monthly payments for as long as you remain eligible. Also, utilizing the CCB won’t disqualify you from other income support benefits, such as the GST/HST rebate and disability tax credit. Having access to extra funds when raising a family is always helpful, so ensure you take advantage of the CCB as well as its provincial equivalents.

In conclusion, if you have more concerns about the Canada Child Benefits don’t hesitate to contact the Filing Taxes team of professional accountants today at 416-479-8532. Schedule an NTR engagement appointment with us and take the first step towards proper management of your finances.

Disclaimer: The information provided on this page is intended to provide general information. The information does not consider your personal situation and is not intended to be used without consultation from accounting and financial professionals. Salman Rundhawa and Filing Taxes will not be held liable for any problems that arise from the usage of the information provided on this page.

If you’re under the low-income bracket and are looking for a job or struggling to meet the basic costs of living in Ontario, you should prepare for the Ontario Works payment dates.

Ontario Works is one of the main pillars of social assistance and welfare payments in the province of Ontario. Ontario Works is a social assistance program designed to help Ontarians who don’t have enough money to cover their basic living expenses. If you have a financial need in the province and have no resources to support yourself, you may be able to get help through Ontario works.

The program also goes a step further in helping eligible individuals find jobs and providing them with training if required. If you need financial support to pay for basic needs, this benefit can help and is disbursed through the Ministry of Children, Community, and Social Services.

Ontario Works is not the only welfare benefit available. Residents of Ontario who have a disability may be eligible for the Ontario Disability Support Program (ODSP).

Below I discuss Ontario Works payment dates in 2022, how to apply for the benefit, Ontario Works amounts and the payment schedule for other benefits including Ontario Trillium and ODSP.

Ontario Works is a form of financial assistance provided to residents of Ontario (Toronto, Windsor, London, Ottawa, Hamilton, etc.) who need help to pay for food and shelter.

This social assistance program also helps recipients find jobs.

In addition to providing a monthly income and job support, Ontario Works also offers health benefits.

So whether you’re looking for help in meeting the cost of food, clothing, housing, and health in Ontario, this program can help you.

Also, if you’re looking for job-related assistance such as job counseling, basic education, job training, resume writing, or a workshop, Ontario Works is there for you.

Ontario Works provides eligible Ontarians who are in financial difficulties with money to pay for food, housing, and clothing.

Here are the benefits you can receive on the Ontario Works payment dates based on your eligibility and situation:

1. Ontario Works Financial Assistance

This assistance aims at helping Ontarians struggling to meet the cost of basic needs such as food and housing costs.

As a result, of your asset, income, family size, and housing costs, you may receive low or high financial assistance.

Thus, for your basic needs, you may receive up to $343 if you’re single or up to $494 as a couple.

But for your shelter allowance, you may receive up to $390 if you’re single or up to $697 if you’re a couple with a child.

However, you may get both the basic needs amount and shelter allowance if you’re living under a board and lodging condition plus a $71 special allowance per month.

2. Ontario Works Employment Assistance

This assistance is available to those looking for a job or job-related assistance such as resume writing, workshops, job counseling, basic education, job training, etc.

Furthermore, even after securing a job, you may still get help from Ontario Works for:

However, to receive this assistance, a person is expected to participate in employment assistance activities.

Subsequently, we shall be looking at the major employment assistance activities.

Employment Assistance activities

3. Ontario Works Health Benefits

4. Ontario Works Transition Child Benefit

You may also qualify for the Transition Child Benefit under the Ontario Works.

However, for a person to qualify for the Transition Child Benefit, they must meet the following requirements:

Furthermore, the amount of OCB you get plus your National Child Benefit Supplement amount determines how much Transition Child Benefit you get on the Ontario Works payment dates.

5. Ontario Works Guide Dog Benefit

If you possess a certified guide dog and are struggling with a disability, you could be eligible for financial assistance toward the cost of the dog’s care.

Thus, you may receive up to $84 monthly to offset the cost of taking care of your dog.

However, your dog must be certified and trained as a guide before you qualify for this benefit.

6. Ontario Works Emergency Assistance

You may also get assistance on the Ontario Works payment dates if you’re struggling financially to survive an emergency as a result of:

Ontario Works payments are made to those that meet the following requirements:

Thus, once you meet the above requirements, you can go ahead and apply for the program and anticipate the Ontario Works payment dates.

Within 20 to 30 minutes, you can apply for the Ontario Works online and start anticipating the Ontario Works payment dates.

That said, you need is to visit the Ontario Works application page to initiate the application.

But before starting, you will be required to provide your home postal code.

Furthermore, you can find your home postal code using Canada Post’s postal code finder.

However, if you’re homeless, you can use the postal code of your nearest social assistance office. Use the office locator to find it easily.

After you provide a postal code, you will be required to fill out a questionnaire related to the Ontario Works program.

Thus, upon answering the questions, you can now start the application process through the following steps:

Step One

Here you will be required to provide your basic information such as your:

Step Two

This step involves reviewing your application by a caseworker.

Thus, you will be assigned a caseworker within four working days of your application. The caseworker will schedule a meeting with you.

Step Three

Here you will meet with your caseworker for the verification of your information and documents.

Consequently, you may be required to provide additional information and documents to verify your information.

Subsequently, you will be required to sign a consent form and your application package to determine your eligibility.

Step Four

After accessing all the necessary information, your caseworker will notify you within four working days about your eligibility and your entitled amount.

Thus, your local Ontario Works office will notify you about your first payment and payment method if you’re accepted.

Step Five

At this step, your caseworker will arrange a meeting with you about your participation in employment-related activities.

However, this may not be necessary if you suffer from a particular sickness or engage in caregiving.

Ontario Works amounts vary depending on the size of your family, your housing costs, and your income.

Financial assistance is provided to cover:

Basic Needs: This includes expenses like food, clothing, etc.

| Number of Children/Dependent Adults | Single | Couple |

| 0 children | $343 | $494 |

| 1 child aged 17 or under | $360 | $494 |

| 1 dependent adult 18 or older | $623 | $652 |

| 2 children under 17 | $360 | $494 |

| 1 child under 17 + 1 dependent adult 18 or older | $623 | $652 |

| 2 dependent adults 18 or older | $781 | $826 |

For each additional dependent adult 18 or older, you get an extra $175.

For additional children aged 17 and under, there are no extra benefits.

Shelter Benefits: This covers expenses related to rent, mortgage payments, property taxes, utilities, heating costs, etc.

The maximum Ontario Works amounts for shelter are:

| Family Size | Maximum Monthly OW Shelter Allowance |

| 1 | $390 |

| 2 | $642 |

| 3 | $697 |

| 4 | $756 |

| 5 | $815 |

| 6+ | $844 |

If you are living in a room and board situation, the rates are as follows:

A special border allowance of $71 is also paid.

Older recipients who are 65 years or older are paid an Advanced Age Item benefit ($44).

And, if you have a guide dog, you may qualify for an extra $84.

While receiving Ontario Works, payments are normally sent directly to your bank account. If you are receiving your payments by cheque, you can sign up for Direct Bank Deposit.

If you do NOT receive your payment, or if you receive an Employment & Social Services letter telling you that your payment is going to be delayed or stopped, contact your caseworker.

| Payment Schedule 2022 | |

|---|---|

| Benefit Month | Cheque Payment & Replacement Date |

| February | Monday, January 31 |

| March | Monday, February 28 |

| April | Thursday, March 31 |

| May | Friday, April 29 |

| June | Tuesday, May 31 |

| July | Thursday, June 30 |

| August | Friday, July 29 |

| September | Wednesday, August 31 |

| October | Thursday, September 29 |

| November | Monday, October 31 |

| December | Wednesday, November 30 |

Ontario Works benefit payments are not included in your income when you are being assessed for welfare benefits.

You also do not pay taxes on these amounts when you file your tax return.

That said, ensure you file your annual income and benefits tax return as this is used to determine whether you are eligible for other benefits such as GST/HST credits and the Canada Child Benefit.

You can receive your payment through cheque, direct bank deposit, or a reloadable payment card on the Ontario Works payment dates.

So if you opt for a cheque, you will receive mail a few dates earlier. However, how soon you receive your payment lies on your area Canada Post delivery.

Consequently, the Ontario Ministry of Children, Community, and Social Services suggests you opt for a direct bank deposit.

This is because a direct bank deposit is an easiest and safest method of receiving the Ontario Works payment.

However, if you don’t have a bank account to receive a direct bank deposit, you should opt for a reloadable payment card.

You can work and earn some income while receiving Ontario Works benefits.

Each month, you’re expected to report your gross pay and net pay using the Statement of Income Report form. Partner’s and adult dependents' income should also be reported.

Your total income for a month will be used to calculate how much you can receive for the following month.

The first $200 received in a month will not count towards your OW financial assistance. In other words, it will not reduce your payments. After this, each additional dollar will reduce your support payments by 50 percent.

The government has not announced any proposed increases to the Ontario Works payment for 2021 and 2022.

The last increases to Ontario Works rates were in 2018. There have been plans to reform the various social assistance programs by the government, but there is no mention of increasing the rates for now.

In February 2021, the Ontario Government announced it has started working with its municipal partners to better connect people with the support they need.

This is the next step in the province’s vision for a renewed social assistance program that was announced in fall 2020.

Over the coming years, the plan is to “create an efficient, effective and streamlined social services system” that helps more people move towards employment and independence.

As part of the changes, a new digital system that aims to make the application process easier and ease the burden of caseworkers is being tested.

The province will also oversee the application and payment of social assistance, with the municipal partners focusing on helping people get back to work and access support for health and housing.

However, critics believe the changes are ill-timed and would cause chaos and uncertainty, especially for ODSP recipients.

The Ontario Trillium Benefit comprises three payments including:

Ontario Trillium Benefit is paid out on these dates in 2022:

Ontario Disability Support Program (ODSP) is another social assistance program from the provincial government of Ontario. As a beneficiary of Ontario Works, you may also qualify for the Ontario Disability Support Program (ODSP).

Both programs are administered by the Ministry of Children, Community, and Social Services.

While Ontario Works is for anyone that needs their living expenses, ODSP caters to people living with disabilities.

ODSP assistance provides income support (basic needs allowance, shelter allowance, or board and lodging allowance), health benefits, and employment support to help beneficiaries find and keep jobs.

A single person with no dependents can receive up to $1,341 per month for basic needs and shelter under ODSP.

If you have a disability, you may qualify for the ODSP on these dates in 2022:

| Benefit Month | ODSP Payment Date |

| January 2022 | December 22, 2021 |

| February | January 31, 2022 |

| March | March 31, 2022 |

| April | April 29, 2022 |

| May | May 31, 2022 |

| June | June 30, 2022 |

| July | July 29, 2022 |

| August | August 31, 2022 |

| September | September 29, 2022 |

| October | October 31, 2022 |

| November | November 30, 2022 |

| December | Not yet available |

[sp_easyaccordion id="4664"]

Now you are informed about the Ontario payment dates and what it takes to be eligible for payment.

But remember, a direct bank deposit is easier and safer to receive your OW payments than a cheque.

Furthermore, you now understand why it’s necessary to apply for the ODSP even as a beneficiary of OW payment.

Ultimately, you should identify and claim any benefit you may qualify for, such as Ontario Trillium Benefit and Canada Workers Benefit.

Thus, the more of these benefits you claim, the more money you will have to supplement your income and improve your finances.

In conclusion, if you have more concerns about the Ontario Work Benefits don’t hesitate to contact the Filing Taxes team of professional accountants today at 416-479-8532. Schedule an NTR engagement appointment with us and take the first step towards proper management of your finances.

Disclaimer: The information provided on this page is intended to provide general information. The information does not consider your personal situation and is not intended to be used without consultation from accounting and financial professionals. Salman Rundhawa and Filing Taxes will not be held liable for any problems that arise from the usage of the information provided on this page.

When the government deposits money into your bank account, it’s filed under a series of different codes. One of them is “Canada Fed”, a deposit you may notice when you review your bank statement. As with any deposit, it’s important to know where it came from to determine if the money belongs to you and how it factors into your budget. The Canada Federal Deposit covers many different programs.

In this article, we detail everything you need to know about federal deposits, including payment dates, and eligibility requirements.

Canada Fed deposit is a direct deposit from Canada Revenue Agency (CRA) on behalf of the federal government and gets handled separately from any provincial financial incentives. The Canadian government also issues out several direct deposits with unclear and often vague descriptions. The Canada Fed deposit is one of them. It could be one or a combination of benefit payments made by the Government of Canada. Payments issued with the caption can be rebates, credits, or one of the benefits administered by CRA. Canada FED also sometimes refers to energy rebates from the Government of Canada.

The main objective of this Canada Fed deposit is to improve the purchasing power of low-medium-income Canadians through tax rebates or credits.

Consequently, eligible persons are not taxed upon receiving this deposit, except for the Canada Workers Benefit (CWB) deposit.

This is the major thing pro about the Canada Fed deposit. Unlike other government deposits, you have the flexibility to spend this payment without worrying about taxes.

Canada FED deposits are tax-free payments by the Canada Revenue Agency (CRA) that include:

To receive these deposits, you must be eligible for one or more of the programs listed above. In most cases, you automatically apply when you file your annual income tax return. The amount for which you qualify changes yearly, and each individual program has unique criteria to participate.

The Canada Fed Deposit is simply a term used in payroll software and bank statements. It represents the money deposited into your account from one or more of the programs. Some individuals qualify for all three programs, while others are only able to access certain benefits.

It’s important to know which of these programs your qualify for so you know how to handle the money for tax purposes.

CCB was designed to help families with the cost of raising their children. It is administered by CRA and provides a tax-free, monthly payment to eligible families with children below age 18. In addition, families may also receive related provincial benefits where applicable.

You can apply for the CCB as soon as your child is born when registering their birth, through your CRA My Account, or by mail.

How much you receive is dependent on how many eligible kids you have and your adjusted family net income for the last tax year. CCB payments are reassessed each year based on your family net income and are indexed to inflation.

Classed either as the goods and services tax or the harmonized sales tax credit, this payment is an equalization amount meant to ensure that tax is only paid once on goods and services. The difference between HST and GST is strictly based on your province of residence. Depending on your province/territory, you may benefit from other provincial/territorial programs under the GST/HST deposit.

The goods and services tax/harmonized sales tax (GST/HST) credit is a quarterly payment to individuals and families with low to modest income. That said, your family income, the number of registered children, and your previous tax return determine how much GST/HST credit you receive.

It is a tax-free payment that is designed to offset or compensate for some of the sales taxes that Canadians pay through GST and HST.

Your GST/HST credit is calculated using the previous year’s net income and paid to start in July till April of the following year.

For example, the GST credit that’ll start going out from July 2021 11is calculated using the net income reported on the 2020 income tax returns.

The Canada Workers Benefit is available to Canadians with medium-low-income. It differs from the other two Canada Fed credits significantly in that it is taxable income. This means that the amount you collect from the benefit adds to your tax bracket calculations. It also means that you owe taxes on the money the program deposits. To enroll in the CWB, you must file your income tax return.

CWB Disability Supplement

If you are eligible for the Canada Workers Benefit, you may also be eligible for an additional disability supplement of up to $713 per year, if you:

Already receive the Disability Tax Credit

Have a minimum employment income of $1,150 (for most provinces)

Have filled out a Disability Tax Credit Certificate (Form T2201)

As I mentioned earlier, the federal payment is administered by the CRA to eligible Canadians under the CCB, GST/HST, and CWB programs.

So to be eligible for the federal payment, an individual must meet the requirements of any of the above programs.

However, each of the above programs has different requirements, but it’s not surprising to qualify for all of them.

Here are the common requirements for the CCB, GST/HST, and CWB programs:

Though all three of the programs included in this deposit category are for those with medium-low-income, other factors also contribute to eligibility. These differ slightly for each program. To maximize your benefits, understanding how to qualify is important.

To be eligible for the Canada Child Benefit, the household must meet the following criteria:

When you file your income taxes for the year, you are automatically enrolled in this program. The government has centralized payments via direct deposit, so you can track these in your CRA portal.

Every taxpayer is technically eligible for this benefit by virtue of paying taxes. However, the actual amount of the benefit deposit varies based on the following criteria:

The Canada Revenue Agency calculates your eligibility regularly, so if you have a change in circumstances, inform them promptly to avoid payment issues.

Because this benefit differs from the other two due to its taxable status, the criteria are unique. You must:

Those with spouses or common-law arrangements have an extra eligibility burden, where you must:

If the household supports dependents, they must:

DISQUALIFYING FACTORS:

Provided you meet the above requirements, and don’t have one of the disqualifying traits, then you can easily access this benefit.

When a child is younger than six, you can get up to $6,765. This amount drops to a maximum of $5,708 per year until the child reaches the age of majority. There are other benefits in the same category as the CCB, including child disability benefits. Though it is technically a provincial/territorial benefit, the funding moves through the federal program and can show up as CCB or Fed.

As with the other programs, it’s designed for medium-low-income households. Accordingly, the exact amount you receive varies based on your earnings for the previous years., Your household size also gets taken into account. For the current benefit period (July 2023 – June 2024), the maximum GST/HST credit is up to:

The program has two components, the basic amount and the disability payment. Single individuals without children are eligible for as much as $24,573 if they live in any of these provinces or territories:

Conversely, if you live in one of the following areas, you have different eligibility:

Depending on the amount you can receive, you will either get a quarterly payment or a lump sum amount.

The amount of Canadian Fed deposit you get depends on how many programs you qualify for and your situation.

Since the Fed deposit comprises three programs, you should expect to receive each deposit on different dates.

However, GST/HST and CWB advance payments are made quarterly. But you can choose to receive a one lump-sum CWB payment during tax periods.

That said, the table below shows the different dates for CCB, GST/HST, and CWB advance payment for 2024:

| Canada Child Benefits (CCB) | GST/HST Tax Credit Payments | Canada Workers Benefit (CWB) |

| January 19, 2024 | January 5, 2024 | January 12, 2024 |

| February 20, 2024 | April 5, 2024 | April 12, 2024 |

| March 20, 2024 | July 5, 2024 | July 12, 2024 |

| April 19, 2024 | October 4, 2024 | October 12, 2024 |

| May 17, 2024 | ||

| June 20, 2024 | ||

| July 19, 2024 | ||

| August 20, 2024 | ||

| September 20, 2024 | ||

| October 18, 2024 | ||

| November 20, 2024 | ||

| December 13, 2024 |

If you want to avoid trouble in the long run, you should ascertain the purpose of the Canada Fed bank deposit immediately after receiving it.

Occasionally, the federal government makes wrong deposits. Although it’s not your fault, you may put yourself in serious trouble if you fail to inform them about the wrong deposits.

Thus, to validate the purpose of the Fed deposit, log in to your CRA My Account. This is where you will find all notices concerning your eligible credits and payment dates.

However, you may go to the message area to check whether the CRA has sent you any message regarding the Fed deposit.

If you have not received any notice or message regarding the Fed deposit and are not qualified for either CCB, GST/HST, or CWB credit, reach out to the CRA immediately.

Moreover, you’re free to spend the Fed deposit if you meet the requirements for the CCB, GST/HST, or CWB credit and find a notification or a message about the deposit on your CRA My Account.

There are multiple government deposits; for ease of budget tracking for both the government and the recipient, there are different codes. If you qualify for the Fed deposit, you likely will encounter one of the following bank deposits as well:

Short for the Canada Refund Income Tax (Canada RIT) is issued by Revenue Canada to those who receive a tax return. It arrives somewhere between one to six weeks after you file your annual income tax return. If the government reassesses your tax return, you may receive this credit at a random time. Check your online portal to make sure you are entitled to it. Since the credit is tax-free, it neither adds to your tax bracket nor do you have to pay tax on it.

For residents of Alberta and Ontario, you can qualify for this benefit. It is income-based, where the amount is calculated when you file your taxes. If it doesn’t show up as a Canada Pro deposit, will likely show up as one of two statement codes:

Families with children under age 18 years of age who are eligible for the CCB and Disability Tax Credit (DTC) may qualify for additional monthly Canada Fed payments.

The maximum CDB is paid per child when your adjusted family net income is $69,395 or less.

Now you have a clear picture of what the Canada Fed payment on your bank account entails.

Also, you know why it’s essential to confirm the purpose of the deposit on your CRA My Account before spending it.

Ensure that you’re really eligible for this deposit, else those few hundreds or thousands of dollars may put you into a costly problem. Getting an unexpected payment that’s rightfully yours? Wonderful. Not actually being entitled to that amount. Less so. The key takeaway about any type of deposit is that you must check that it is rightfully yours. When the money is in your account, it’s your responsibility. This could mean anything from getting an overpayment, spending it, then having to repay it to simply paying taxes on the benefit.

There are plenty of government assistance programs available for Canadians to get financial support. As long as you qualify, most of the application comes when you file your taxes. Provided you are prudent about record-keeping and tax savings, you can use these Canada Fed deposits to strengthen your finances. Furthermore, other federal government deposits such as Canada RIT and Canada Pro can add up to building your long-term financial security.

[sp_easyaccordion id="4577"]

If you have more questions about the Canada Fed deposit, give a call to CRA at 1800-959-8281. For other information, contact the Filing Taxes team of professional accountants today. Schedule an NTR engagement appointment with us and take the first step towards proper management of your finances.

Disclaimer: The information provided on this page is intended to provide general information. The information does not consider your personal situation and is not intended to be used without consultation from accounting and financial professionals. Salman Rundhawa and Filing Taxes will not be held liable for any problems that arise from the usage of the information provided on this page.

My Account with Canada Revenue Agency (CRA) is the best way to make sure you are taking advantage of all the government benefits available to you and your family.

The Canada Revenue Agency (CRA)’s My Account is a secure portal that lets you view and manage your tax-related and benefits information online. This is the best way to keep up to date and manage all your affairs with CRA. Most of the service providers are moving online and reducing physical mail. Well, the CRA is no exception.

My Account is your one-stop online Canada Revenue Agency service channel.

My Account is:

My Account is your one-stop online Canada Revenue Agency service channel. With the My Account, you’ll have access to the following services:

Note: This is not a complete list. Refer to the CRA website for a full list of services you can access with the My Account.

Registration to Process

Setting up My Account on the CRA website is simple and straightforward. To register go to canada.ca/my-cra-account.

Important: To register for My Account, you must have filed a tax return for the current or a previous year.

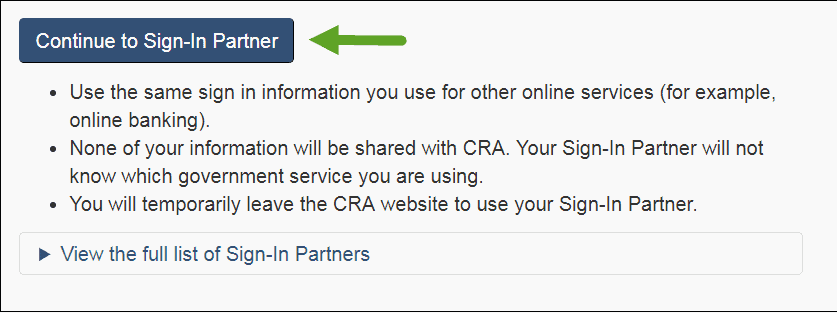

• using Sign-in Partner (such as your bank)

2. Select your Sign-In Partner (such as the financial institution you bank with).

3. You’ll be taken to your Sign-in Partner’s website. Log in with the username and password that you normally use for this website.

4. Enter the requested information (such as your social insurance number, date of birth, current postal code, and an amount from your current or previous tax return).

5. Once you complete the registration process, you’ll have instant access to some of your tax information.

Within 10 business days, you’ll receive a letter from the CRA with your CRA security code. Log in to your My Account using your Sign-in Partner. When prompted, enter the CRA security code you received. Keep in mind, your CRA security code has an expiry date – be sure to follow instructions in the CRA letter before the code expires.

Once you enter the CRA security code, you’ll be able to access all of the services offered by My Account.

• creating a CRA user ID & password

Within 10 business days, you’ll receive a letter from the CRA with your CRA security code. Log in to your My Account using your CRA user ID and password. When prompted, enter the CRA security code you received. Keep in mind, your CRA security code has an expiry date – be sure to follow instructions in the CRA letter before the code expires.

Once you enter the CRA security code, you’ll be able to access all of the services offered by My Account.

Once you receive your CRA security code, return to My Account, log in and enter your security code when prompted.

You now have full access to all the My Account features!

Want to make your life easier with hassle-free access to your tax and benefits information? Consider registering for a CRA My Account today.

Tax time can be a headache! Take control of your accounts and finances by opening a CRA online account. If you need any further help to start the registration process, For advice and assistance with tax planning, a CRA tax dispute, or other tax issues, get in touch with Filing Taxes today to see how we can help. Experts at Filing Taxes will be happy to assist business owners in this pursuit. To speak with an experienced accountant, contact Filing Taxes either at 416-479-8532 or [email protected]. Schedule an NTR engagement appointment with us and take the first step towards proper management of your finances.

Disclaimer: The information provided on this page is intended to provide general information. The information does not consider your personal situation and is not intended to be used without consultation from accounting and financial professionals. Salman Rundhawa and Filing Taxes will not be held liable for any problems that arise from the usage of the information provided on this page.

Tax filing and payment obligations to CRA are sometimes, intentionally or inadvertently, overlooked or inaccurately met. Considering that many taxpayers may have different and multiple tax filing deadlines, it is not uncommon for taxpayers to mistakenly miss filing deadlines. Mistakes happen when filing taxes but, unless they are corrected properly, you or your business may be on the hook for additional interest and penalties and may even risk a criminal record. The Canadian tax authorities recognize the likelihood of this situation and it is precisely for this reason that the CRA administers the Voluntary Disclosure Program (VDP). It is an opportunity for the taxpayers to mitigate their risk by coming forward with the non-compliance through Canada’s Voluntary Disclosures Program.

Voluntary disclosure is the name of the Canada Revenue Agency (CRA) Tax Amnesty Program that allows non-compliant Canadian taxpayers to correct back tax problems and come back into the tax system. It allows the taxpayers to self-report to the CRA unfiled tax returns or unreported income, unreported offshore assets, or other discrepancies in tax filings. Taxpayers must submit a voluntary disclosure application along with corrected or missing tax returns for the resolution of tax issues before potentially facing harsh tax penalties and prosecution for tax evasion.

This program can receive a wide range of tax situations. The below list a few of the most common scenarios:

However, these reliefs are provided on a case-to-case basis. Not every taxpayer will be able to obtain all these reliefs.

The CRA grants a higher level of relief to those who unintentionally made an error than those who purposefully avoided their tax obligations.

Any taxpayer can make a disclosure under the VDP, to put their tax affairs in order. You can be an individual, business, trust, resident or non-resident, employer, or payer. Canadian taxpayers who approached CRA before the Canada revenue agency commences any type of audit or enforcement action are eligible to apply for Voluntary disclosure or tax amnesty penalty relief. The other main requirement is that the tax omission is at least one year old and that tax penalties be owing.

The CRA voluntary disclosure program (VDP) only applies to the last 10 years of tax issues. This means that you’ll need to apply for Voluntary Disclosure 10 years or earlier from the tax year in question. For example, if your VDP application was submitted in May 2018, relief would only be available for the 2008 tax year and subsequent years.

CRA has no ability under the Tax Act to provide interest or penalty relief for greater than a 10- year period. So, what happens if a Canadian taxpayer has more than 10 years of unfiled returns, or has unreported income or unreported offshore assets, for more than 10 years? A taxpayer with more than ten years of tax problems will only be provided with interest and penalty relief for the last 10 years. However, one of the important benefits of the CRA voluntary disclosure program (VDP) is relief from possible tax evasion prosecution.

When you begin the CRA Voluntary Disclosure process, you need to tell the agency information that it does not already have. That’s why it’s critical to not only complete your application correctly but also to ensure that you are using the program in the right way. The CRA Voluntary Disclosure Program (VDP) only applies in certain circumstances.

After you submit your disclosure, the CRA may contact you by letter to ask for more information. The information must be provided within the timeline requested or the CRA voluntary disclosure request may be denied.

Once the CRA has reviewed your application, you will be informed in writing as to whether or not the agency has accepted your disclosure and what relief has been granted. If you disagree with this assessment, you may request a second review of your file. However, a second review will not be granted if you have not provided the CRA with the information requested on time.

You'll have a 90-day time limit. It begins with the Effective Date of Disclosure (EDD). This is the day when the CRA has received the completed application submitted by your authorized Canadian tax accountant. You may ask for an extension in writing if you need it.

To enroll in the voluntary disclosure program or VDP an eligible Canadian taxpayer must submit a voluntary disclosure program relief with all required information along with all necessary tax returns and must make payment of all estimated taxes owing. In some cases, payment arrangements can be negotiated with the Canada revenue agency.

You can submit the RC199 Voluntary Disclosure Form and T1135 Foreign Voluntary Disclosure Form electronically or by mail. The safest way to submit it is through an experienced Canadian tax accountant. A tax accountant will be able to assist you and ensure that all necessary information is included and that there are no mistakes and set the groundwork if a subsequent court appeal is required.

Whether to accept a VDP application is subject to CRA's Discretion.

Not all disclosures by taxpayers are accepted by the CRA under the Voluntary Disclosures Program. The CRA officer is going to decide whether you have met all the requirements and whether your application is going to be accepted or not. It is highly recommended to consult with an experienced Canadian tax accountant to maximize your chance to be accepted.

You can file for an appeal. If the Canada Revenue Agency rejects your VDP application, your tax accountant can submit a second-level review request. If that is not accepted then a judicial review application in the Federal Court of Canada can be filed. This request must be done within thirty days from the date in which the Director of the Tax Services Office denied your request for a reconsideration of the original decision.

You may add additional information and/or changes if these arose since the original application was made. However, if the new information was left out of the application and it was therefore denied due to a delay in providing complete information, your application will not be considered for review.

It is technically possible to deal with the CRA on your own. However, it is advised to seek the assistance of an experienced accountant. The process may appear straightforward, but complications can pop up along the way. These depend on your individual financial situation and your reason(s) for not paying on time. Hiring a professional accountant adds an extra layer of comfort that your VDP application is complete.

Since one is exposing him or herself by providing potentially incriminating information to a governmental authority, hiring a tax accountant with expertise in statutory tax law is critical for all taxpayers interested in making a disclosure to the CRA’s Voluntary Disclosure Program.

Although the VDP is a very beneficial resource, it is essential to disclose your tax issues with an expert tax accountant to ensure that your omitted income does qualify for the disclosure program or if there are any other relevant tax treaties and provisions that can lead to a more favorable conclusion.

The CRA can go back to the dawn of your financial life and reassess a taxpayer for any and all the years. Staying non-compliant can result in serious penalties including gross negligence penalties and even criminal prosecution.

Professional accountants at Filing Taxes can ensure you have thoroughly and accurately complied with all the conditions that must be met to submit an authentic voluntary disclosure. Our offices in Toronto and Mississauga can provide all the steps to submit a successful VDP, including tax owing estimates, unfiled income tax returns, back taxes, unfiled HST, sales tax returns, any unreported income, and unreported foreign assets on the T1135 form.

You can trust our experienced team to work with you and the CRA to resolve your tax situation. Our years of experience and deep understanding of CRA processes make us the right choice if you are considering applying for the CRA Voluntary Disclosure Program as well as in dealing with nearly any tax situation. So, here’s your opportunity to get all your questions and concerns answered. All consultations are completely confidential whether you finally choose us or not. Feel free to reach out to Filing Taxes at 416-479-8532. Schedule an NTR engagement appointment with us and take the first step towards proper management of your finances.

Disclaimer: The information provided on this page is intended to provide general information. The information does not consider your personal situation and is not intended to be used without consultation from accounting and financial professionals. Salman Rundhawa and Filing Taxes will not be held liable for any problems that arise from the usage of the information provided on this page.

This is actually a common question, and it’s really important that you do it right. How do you do this, depends on various factors with your pre-existing business, as well as your new holding company.

You can surely transfer an existing business to a newly incorporated holding company on a tax-free basis by implementing a Section 85 Rollover.

There are few reasons that compel people to convert their pre-existing business to a new holding company. One of the primary reasons is that the business has grown. This alone can be a significant reason to switch the business to a new holding company.

There are a number of things to consider when looking at switching your pre-existing business to a new holding company. Below are the commonly asked questions from our clients when they reach out considering what is involved in making the transition to an incorporated company.

Can I use the same business name?

Yes, you can use the same business name as you are currently using, you just need to add a legal ending to the business name from these six options:

It is good to know in advance from an accountant about this kind of stuff so in the future you don't have to face problems or difficulties.

What other information is required to Incorporate?

Can a new person be added to the incorporation?

Yes, you can. If you wish to add someone as a director to the incorporation who was initially not part of your pre-existing business, now is the perfect time to add them. A crucial time for your company, so to get the knowledge from an accounting firm that what you are going to face.

In which categories of incorporation, we offer our services?

What changes are required after completing the incorporation?

We are here to assist you to make the process of converting a pre-existing business to a new holding company a seamless and, easy process where we move with you step by step through the incorporation process. We need more information about your business and its existing setup to guide you in more detail. If you need any further information and you are still uncertain about incorporating your small business, our experienced and professional team at Filing taxes is here to set you on the right path considering your personal business situation. Feel free to reach out to Filing Taxes at 416-479-8532. Schedule an NTR engagement appointment with us and take the first step towards proper management of your finances.

Disclaimer:

The information provided on this page is intended to provide general information. The information does not consider your personal situation and is not intended to be used without consultation from accounting firms and financial professionals. Salman Rundhawa and Filing Taxes will not be held liable for any problems that arise from the usage of the information provided on this page.

Tax Audit– a dreaded word for any taxpayer. There is one thing we do not want to see in our mailbox, it’s a letter from the Canada Revenue Agency. Even worse, if it is a letter from CRA informing us that we are being subject to a tax audit. Should that happen, professional support from Filing Taxes can help you get through a CRA audit.

A tax audit is a review/examination of your tax return by the CRA to verify that your income and deductions are accurate. During a tax audit, CRA closely investigates the books and records of a taxpayer to ensure whether they are fulfilling their tax obligations, abiding by tax laws appropriately, and receiving the benefits and refunds to which they are entitled.

We are all human, so mistakes can happen. If CRA spots one error, they may assume there must be more, and they will investigate. It is vital to mitigate the risk of suspicion of potential issues by CRA. This can be best done by professionals where Filing Taxes brings a hand of support.

When you get audited, you will receive a notice from the CRA stating their intention to audit. The audit will begin with a letter from the CRA, never a phone call, informing you that you are being audited. The letter will put you on notice and specifies the years that the CRA wants to audit as well as the documents and records it wants to see. The documents may include previous tax returns, business records, personal records and even records of family members just to mention a few. It will also notify the date, time, and location where the audit will take place. It could be a desk audit that occurs at the CRA offices, or it could take place at your place of business. You will then have the opportunity to make submissions that the auditor required to review and respond to CRA correctly.

If the auditor suspects any issues in the documents you provided they will inquire about it during the audit. You also have the right to ask questions or raise any concerns you may have. It is essential to use care when discussing your tax situation with the CRA. You will be required to be honest and transparent, but it is also important to understand the potential implications of any information that you provide.

The audit can be concluded with different outcomes.

This detail will be mentioned in the final letter issued by the CRA. You have the right to disagree with the result of a tax audit, you can choose to discuss it with the auditor as an attempt to resolve the situation. If this attempt does not work for you, you can appeal for a reassessment. If you decide to formally object to an assessment made by the CRA, or appeal a CRA decision, it is crucial that you hire a professional. Contact Filing taxes for more information to know how we can assist before, during, and after the audit process. We provide accounting and bookkeeping services on your needs.

Even if you believe that you have not done anything wrong, CRA auditors are specially trained to find issues with tax returns. The best thing to do is respond and co-operate. Taxpayers are sometimes tempted to represent themselves in a CRA audit this could be a costly mistake. Not responding would be a bad idea, but the worst would be responding incorrectly.

Let our professional accountants at Filing Taxes help you seamlessly get through the CRA audit. We can assist you at any stage of the audit process. We can develop an audit strategy, help you in the submission of information required by the CRA, accompany you to audit meetings, ensure a fair audit process and secure a favorable outcome. If you decide to object to the audit result or appeal a CRA ruling, we are there to help. Trust us to help you through your audit process. Don’t confront the CRA alone.

A variety of potential triggers in tax returns tend to raise questions and attract unwanted attention from CRA. Sometimes a taxpayer is randomly selected for an audit. But apart from a random tax audit, there are a variety of triggers because of which you can be targeted for a tax audit. Some of them may include:

Above are just a few situations that might raise a red flag to catch CRA's attention for an audit. To deal with the audit process smoothly keep organized records of your finances using a bookkeeping and accounting system. In certain cases, you might not be able to avoid a tax audit, but you can certainly take the right step of bringing on board Filing Taxes to ensure that the process goes in a breeze. Professionals can communicate with CRA on your behalf, which helps control the flow of information and guards you from revealing more than you legally need to.

CRA states that the time to complete an audit depends on several factors, such as:

Well-maintained records and professional accountants will help to reduce the time it takes to do an audit. If you don’t have some records you can request to get the copies from the parties who prepared them. If you still can’t manage to get them the situation can be discussed with the auditors to sort out ways to confirm the amounts reported on your return.